Seeking inspiration from nature, the unity of bioplastics and carbon capture signifies more than a business strategy—it's a pivotal step for our species. This symbiosis outlines a sustainable path forward, intertwining bioplastics and carbon capture to shape a resilient and eco-friendly future.

Plastic has seamlessly integrated into every facet of our daily lives. From packaging to medical devices, plastics, especially PET (polyethylene terephthalate) variants, are irreplaceable due to their lightweight, flexibility, and resilience.

However, as our dependency on the material has grown, so has the environmental burden that has come with it. With the limits of recycling and the circular economy all too apparent the quest for sustainable alternatives to the use of fossil fuels has steered an important part of the conversation towards bioplastics and more recently carbon capture technology.

Together, they could usher in a new era of environmental stewardship that hands PET plastic a significant role in reducing carbon emissions from other industries.

The PET plastic predicament

PET plastic’s popularity is undeniable. It’s strong, versatile, and clear—qualities that have endeared it to the packaging industry. However, the elephant in the room remains the environmental impact. With millions of tons produced annually, PET’s reliance on fossil fuels not only increases the industry’s carbon footprint but also exacerbates the planet’s looming waste crisis.

While recycling levels of PET plastic are already well above other types of plastic, the shortfalls of the current recycling system compound the flaws in a system that still relies heavily on virgin fossil fuel stocks for its production.

Full circularity of the industry would lead to very little need for the level of virgin fossil fuel feedstocks – which currently account for more than 90% of annual plastic production but a third improvement would be required on the path to zero: the replacement of fossil-fuel based polymers by polymers produced using alternative sources.

Yoni Shiran, Partner at Systemiq where he leads the plastics and packaging division, says that increased recycling will only get the industry so far in its bid to reach net zero and comply with its commitments under the Paris agreement to halt carbon emissions to a level that would cap rising global temperatures..

In its “The Net Zero Systems Change Scenario”, SYSTEMIQ outlines a potential pathway to a net zero emissions plastics system by 2050.

Shiran, who co-authored the report, looked at how the plastic industry in Europe could reach overall recycling levels of 33% by 2030 but will need to invest heavily in circular solutions in the next five years if it stands a chance of achieving the goals laid out in Paris by 2050

“So 33% by 2030 I think is a lot, it’s definitely not enough and definitely doesn’t get us to Paris, but it’s a great starting point and circular solutions can take us to 78% reduction by 2050 if we implement them at scale,” he says but to achieve net zero, he argues, “we need to bring in additional solutions, such as switching feedstocks to bio-based sources, implementing a kind of blue and green hydrogen, electrified crackers and carbon capture technologies. Those are those at the heart of getting to the net zero.”

The shift away from fossil fuel stocks towards renewable feedstocks completely would enable the industry to move to zero, without it there will always be the need for some degree of virgin fossil fuels..

SYSTEMIQ outlines what it calls “The Net Zero Systems Change Scenario” as a potential pathway to a net zero emissions plastics system by 2050.

As well as the greening of the energy mix and an increase in circularity to 78%, SYSTEMIQ’s most aggressive scenario expands the role of hydrogen and the use of alternative feedstocks from both biological sources and CO2 capture.

“Emissions could be cut in more than half by using renewable energy sources, however, a 93% reduction from the baseline could be achieved by 2050 if renewables are combined with the use of bioplastics,” says Jiajia Zhen in her report on Strategies to reduce the global carbon footprint of plastics.

The Bioplastics boom

There are three types of biomaterials that can be used to replace plastics made from fossil fuels. In total 2.2 million tonnes of bioplastics were produced in 2022. Despite its rise in popularity it still represents less than 1% of annual plastic production.

As McKinsey outlined in its report on biomaterials: “Beyond simply reducing cost and environmental impact, biomaterial companies must understand the technical differentiation of their products and the value chains in which they are looking to sell.”

The relative importance of these factors varies across three biomaterial product types, according to McKinsey with potential use cases for different end markets. The three different approaches include.

- Drop-ins:

This bio-based production route is used to make a product traditionally derived from petrochemicals—for example, Braskem’s bioethanol-based polyethylene. “Drop-ins” refer to chemicals that can essentially be dropped into existing products without changing surrounding operations. For bio-based drop-in chemicals, life-cycle carbon-emissions reductions of 50% (or more) are possible relative to traditional petrochemical routes, but this will vary based on the specifics of the bio-based and petrochemical routes. This represents a significant value proposition for companies looking to reduce their Scope 3 footprints. Companies that succeed with drop-ins can develop efficient, cost-competitive (although not necessarily lower-cost) processes and identify the specific customer segments that are interested in greener materials. - Bio-replacements:

For this product type, a bio-based chemical is used to make a new material that is effectively at parity for measures such as technical performance and cost but that offers a significant improvement in environmental impact—for example, novel fermentation-derived surfactants used in detergents. These are perhaps the most difficult products to succeed with because they can require complex changes across the value chain without delivering technical differentiation. Success requires sharply targeting applications that have low regulatory and testing barriers to incorporate new materials and build a strong consumer-facing element. This way, beneficial environmental impact is optimized. - Bio-better: Unique biochemical synthesis routes can enable completely new combinations of material properties, such as biotech-derived optical films. In this case, the technical advantages are the primary driver of product adoption, with the added bonus of enhancing the environmental profile. The traditional specialty-chemicals playbook for successful commercialization largely applies to these products. Furthermore, sustainability presents many exciting new problems to solve through innovation—for example, not only reducing the embedded emissions in a car but also delivering new high-performance, bio-based chemistries that can further vehicle recyclability (via debondable adhesives) or increase the lifetime of batteries and enable fast charging (via heat dissipation).

A transition to bioplastics isn’t just about eliminating the negative impacts of petroleum-based plastics but about actively contributing positively to the environment.

Bioplastics, derived from organic biomass sources, are not only renewable but can also be biodegradable, albeit often under very specific conditions that are not easily reproduced in nature.

Some materials have been developed to replace flexible plastics that can be broken down by natural processes, in contrast to their synthetic counterparts which can persist in the environment for centuries.

Innovative companies like Sway and Zerocircle are already producing biodegradable films and plastic bags from seaweed but to date there has been no alternative developed for PET that maintains the characteristics required of the material for food packaging and also allows it to break down naturally in nature.

As a consequence research and development has focused on drop-in solutions that reduce the carbon footprint of PET plastic by partly replacing the use of fossil fuels.

While investment in agriculture as a source of fuel stocks for polymers like ethylene comes with other environmental and social concerns including water usage and competition for land with food stocks, carbon capture offers further environmental upside if developed effectively.

“Exclusive dependence on biological sources of carbon feedstock is risky, but by expanding the use of captured CO2 (enabled by a clean hydrogen economy), the plastics system could strategically reposition itself as a carbon sink and enabler of climate change mitigation,” says Shiran.

Some of the companies positioning themselves in this final frontier for the industry, include Lanzatech, Newlight Technologies and Avantium.

Technologies that capture carbon and convert greenhouse gases like methane and carbon dioxide into feedstocks for the industry, are still proving themselves as financially viable alternatives but they do offer a regenerative and arguably redemptive pathway for plastic from perceived problem to undisputed solution.

Recently carbon capture and reutilization technologies have been successfully piloted to reduce emissions from producing PET while simultaneously capturing carbon emissions from other heavy polluting industries such as steel mills.

Carbon Capture: turning the tables on emissions

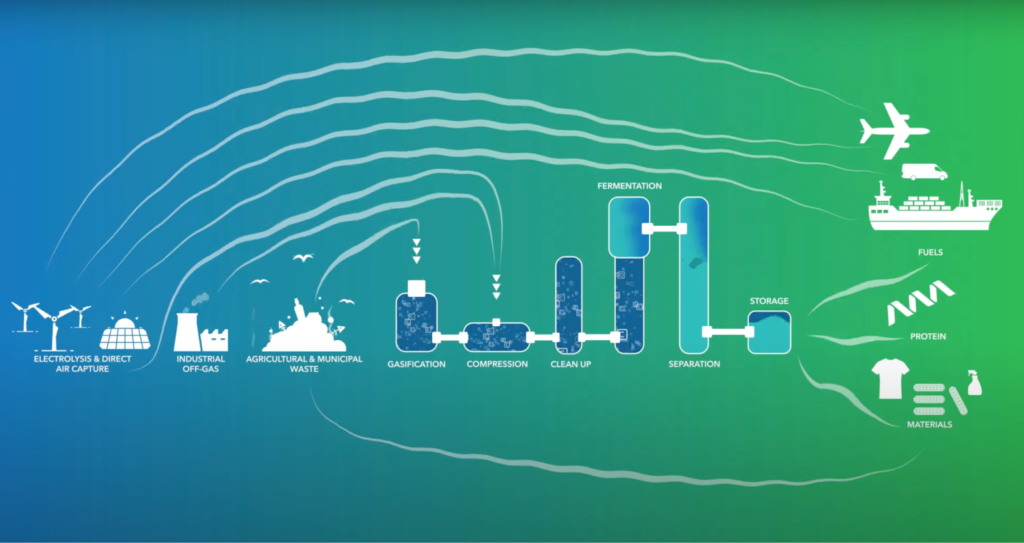

Carbon capture technology’s promise is not just in storing away harmful carbon dioxide but in utilizing it as a resource.

Industries, especially heavy polluters like coal-powered steel mills, release vast amounts of CO2. Capturing and converting this CO2 into useful products, such as feedstock for bioplastics, can have a dual effect. Not only are emissions reduced, but we also get value-added materials in the process.

“We kind of look at it as an industrial symbiosis,” says Freya Burton, Chief Sustainability Officer at LanzaTech, one of the leaders in the field.

“If you apply the idea of biomimicry and how animals and plants might live together in harmony where waste becomes the nutrient source either for plants or for other animals. It becomes part of this symbiotic relationship to create these unlikely partnerships,” she says. The company is working closely with Plastipak Packaging and retailer Migros to create a low-emissions bottle for the environmentally-friendly Swiss brand.

“When we think of a steel mill which is emitting pollution, working with a cosmetics company who is looking to make packaging for shampoos or bath products, they would never normally come together except for the need to take that waste stream and use that as a resource,” says Burton.

“Both of them benefit from moving away from the heavily fossil commodity cycle where there’s price fluctuations, there’s environmental impact and so on. By working together, they can actually reduce their impact. And also there’s a sort of a benefit from a cost perspective that they can now create these new circular systems. That’s always been part of what we offer. Within the organization we’re looking at technology developments. How can we access new feedstocks? What other products could we make? Who else could we bring into this kind of symbiotic relationship?”

For Migros, the low carbon component MEG drops in to make PET that can be readily recycled with the same effectiveness as plastic produced from fossil fuels creating high quality materials that can be used for food packaging and pharmaceuticals. MEG used to create the ethylene component that comprises 30% of PET helps reduce the carbon footprint of the product.

Merging the benefits of bioplastics with the promise of carbon capture technology offers a novel solution to two of humanity’s most pressing environmental challenges: plastic waste and carbon emissions. The integration can pivot industries away from a linear ‘make-use-dispose’ model to a more circular ‘capture-use-recycle’ model.

The incorporation of carbon capture with bioplastic production can effectively lead to plastics made from recycled greenhouse gases. Such an innovative approach ensures that CO2, often vilified as an environmental villain, can be the hero in our fight against plastic pollution

Filip Petrovic, the commercial director of Plastipak Packaging, says the full details of the environmental gain offered by switching to MEG produced with carbon captured from steel mills in China are yet to be fully defined by a Life Cycle Assessment, but the positives are all too clear for its client.

“So the benefits are there and are evident,” he says. “We are just waiting for some final reviews to quantify exactly the improvement. We are hoping that regulatory bodies recognize the CO2 feedstock materials as a sustainable one. We are starting a new industry and new applications together with LanzaTech. This technology is bringing many benefits apart from being sustainable. It’s a virgin-like material, so a really high performing material without aesthetic defects. Recycling this type of plastic will further improve the LCA of the recycled pet because in the start we didn’t engage with the fossils, but we recycle waste gases,” says Petrovic.

Real-World hurdles to overcome

The intersection of bioplastics and carbon capture technology is more than just an exciting scientific development; it’s a beacon for a sustainable future. However, challenges lie ahead. Regulatory bodies need to recognize the immense potential and offer support in the form of certifications and endorsements.

Additionally, as Petrovic states, this merger could incentivize brands to invest in and adopt this technology, driving the market demand essential for scaling and widespread adoption.

While the real-world implications of merging these technologies are significant, the principal hurdles to its widespread implementation are still there to overcome.

Some of the issues revolve around the definition of the technology and a different view of its value compared to carbon capture and storage (CCS) initiatives given favorable status in the Inflation Reduction Act, which introduced incentives to a host of green technologies when it was passed in the US in 2022.

“The problem we see today is that both of these industries are pretty new, but there’s a challenge in that carbon capture and utilization isn’t included in a lot of the legislation as CCS is,” says Burton.

“Burying carbon gets more credits than using it to make new products. In some proposed legislation in Europe using carbon in chemicals to make consumer goods is not considered proper utilization. Only storing it in rock is considered utilization. And so if you think about that, why would anybody be incentivized to do anything with that carbon if there’s no benefit? And why are governments only thinking about incentivizing burying carbon into rock when it’s perfectly usable and can be made into stuff we need?”

Furthermore with brands seeking to fulfill their pledges to increase the quantity of recycled material in their packaging, carbon capture and utilization could benefit from a more generous definition of what is considered recycled content, says Burton.

“A big challenge is that it really feels like policy today is preventing large scale uptake of carbon capture and utilization technologies. The brands, they really want it, they’re really interested but if they have to pay a huge price difference because we’re still compared to fossil and there’s no incentives or tax credits or they are not even mandated to include it, then it does make it challenging,” she says.

“From our discussions with brands, they’re really concerned there isn’t enough mechanical recycling infrastructure to provide the recycled materials, and recycled carbon isn’t included as a recycled material. So they’re kind of stuck because there’s not enough mechanically recycled PET and they can’t include recycled carbon, it might not count towards other quotas and so in some ways it’s like even just that tiny little different definition of whether it’s recycled, whether this is counts as recycled, this could be an enormous lever for something like this, because if it was, then it would give packaging companies other options basically in terms of 100% their pledges and quotas.”

The benefits of the technology being rolled out go beyond reduced waste and lower emissions, but also towards tangible, far-reaching benefits across sectors – PET plastic as a regenerative force in other industries through systems thinking.

- Economic Revitalization: Industries, especially heavy manufacturers, can benefit from an additional revenue stream. By capturing carbon, which was once a waste product, the emission reductions can be traded as a valuable raw material for bioplastic production.

- A Boost to Sustainability Credentials: Brands can tout not just eco-friendly products but also showcase a commitment to a greener production process.

- Diversification for Heavy Industries: Sectors like coal-powered steel mills, often seen as environmental burdens, can pivot and diversify, becoming part of the solution

The financial challenges that need to be overcome, however, remain great, according to Shiran.

“The business case is there. It can be done relatively easily, but it requires massive amounts of upfront investments and that investment will only flow if the right economic incentives are in place and if we can de-risk those investments,” says Shiran.

You ask, how do we plan for technologies that don’t exist yet? I would argue technologies, the technologies just for the most part, they’re not on the scale that we need them. They’re not the cost that we need them. They’re not the efficiency that we need them to be. So there’s definitely a lot of work to be done. And here’s where R&D and investments come in but the technologies at the essence, they exist and the learning curve that we’ve been seeing for these technologies has been quite steep, at least for some of them, both in terms of the cost and in terms of the efficiency. So I believe that these technologies, you know, talk about CCS, carbon capture and storage, CCU, carbon capture and utilization, electrification of crackers using bio based, all these hydrogen, all these things exist. None of these things are something that somebody has to dream up, right? These things exist. There are more scales than just labs, right? Many of them are pilots. Many of them have seen investments of millions, sometimes tens of millions or even more than that. So these are definitely kind of starting to scale for me,” he says.

A sustainable symbiosis

In a world grappling with environmental crises, the merger of bioplastics and carbon capture offers a glimmer of hope. Embracing such innovations is not just beneficial for businesses or the environment; it’s crucial for the future of our species. As we march towards a sustainable future, the symbiotic relationship between bioplastics and carbon capture technology could very well be the torchbearer leading the way.

For industries and consumers alike, the call to action is clear: Support, invest in, and champion these integrated solutions. Only through collective effort can we transform this promising technology into a global, transformative movement.

If you like this content and would like to help close the loop on plastic waste then join the adaPETation® Network by clicking on the button below.

USEful links

Share it

THE HISTORY OF PLASTIC

Throughout the history of plastic, PET has been crucial in keeping food fresh with lightweight and durable packaging solutions that have helped reduce food waste for almost a century. Learn all about the invention of plastic and the important role it has played feeding people and saving the lives of humans and elephants in the adaPETation® timeline of the history of plastic.

Home » Symbiotic solutions: bioplastics meets carbon capture