The world has signed up to end plastic waste, but how do we realistically achieve this? Which countries are driving changes in the regulatory framework for the industry and how can we all make sense of this rapidly changing space?

On Wednesday 2 March 2022, ministers and representatives from 173 countries formally adopted a resolution to start negotiations for a legally binding agreement to end plastic pollution. But with the flow of plastic into our oceans set to double by 2040, and plastic production forecast to be the biggest growth market for oil demand over the next decade according to the International Energy Agency, we now face the major challenge of how we actually close the loop on plastic waste.

UNEP’s agreement marks a historic and encouraging day in the campaign to beat plastic pollution, as it shows how the world has broadly accepted that current production and consumption systems have taken us close to breaking point and threaten the boundaries of a healthy planet. The treaty seeks a complete transformation in our relationship with plastic waste, which means we need a fundamental overhaul in the linear systems governing how these materials are produced, used and disposed of.

Shifting to a Global and Regenerative Mindset

Looking at the big picture, businesses can no longer afford to fixate on their part of the equation and need to understand their role in interdependent systems. With new legislation emerging, now more than ever there is a clear need for industry to collaborate across the entire value chain. Of course this is easier said than done.

Author and regenerative business expert Carol Sanford talks about looking at the “nestedness of living systems”, much like how all forms of life in an ecosystem are dependent on the health of the whole.

“The great need now is not for improvements in parts, but instead for shifts in whole systems,” she explains. “The old way works by cutting parts from wholes and attempting to improve them in isolation. But living systems, the basis of the new paradigm, always work as fully integrated wholes, and those who work with them create cascades of beneficial change through strategic interventions. This is the way businesspeople need to work, by creating enlightened disruption of whole systems for the purpose of regenerating them.”

It’s this kind of collaboration that will drive the realization of a future free from plastic waste, and possibly shape how negotiators in the plastic waste treaty tackle its formulation in coming years.

The regenerative movement always seeks to build on what has already come before, honoring the work done in the past. With this in mind, extracting lessons from the success and failures of previous environmental agreements before shaping new regulations is going to be crucial to ensure that we do not end up generating negative outcomes.

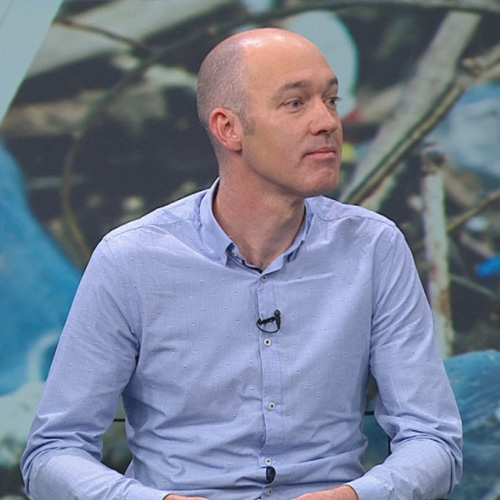

Steve Fletcher, Professor of Ocean Policy and Economy at the University of Portsmouth, says that while it’s difficult to draw lessons from other global treaties given their complexity and context, the structured approach of the 1989 Montreal protocol might be a useful template for the mission to reduce plastic waste to zero.

“Over the last 30 years, the provisions of the Montreal protocol have managed to shrink the hole in the ozone layer. The protocol’s success is often attributed to national targets for progressively reducing the production and use of ozone-depleting substances in refrigerators and aerosols, for instance,” says Fletcher. “Given the clear need for globally coordinated action to tackle the plastics crisis, the agreement may need to borrow more from the prescriptive actions of the ozone-saving Montreal protocol to achieve its targets.”

What measures have countries around the world taken leading up to this point? Who is ahead of the curve, and where are others lacking? Is enough being done at a legislative level to help foster a regenerative revival? We look at a high level snapshot of the regulations shaping up in regions around the globe.

Europe

The EU Plastic Strategy: In recent years, Europe has adopted perhaps the most aggressive approach to tackling the problem of plastic waste, off the back of the first continent-wide plastic strategy introduced in 2018. The new plans pledged to make all plastic packaging on the EU market recyclable by 2030, reduce the consumption of single-use plastics and restrict the intentional use of microplastics, all of which is already impacting the landscape of the PET value chain increasing significantly the demand for recycled materials.

Under this directive, PET drink bottles will be required to contain at least 25% recycled plastic from 2025, moving up to 30% from 2030.

EU plastic tax

At the beginning of 2021, the EU introduced a plastic tax on non-recycled waste in an effort to boost recycling rates. A uniform call rate of €0.80 per kilogram is applied to the total weight of contributions, calculated based on Eurostat data which member states already collect and provide under existing reporting obligations. While this initiative has been widely lauded, others like Jürgen Resch, chairman of the environmental protection agency Deutsche Umwelthilfe, have said the tax rate is too low to really encourage companies to lower their plastic consumption.

Plastic tax in the UK

The UK followed suit on 1 April 2022 with its own tax structure of £200 per ton of plastic packaging placed onto the UK market that contains less than 30% recycled content, estimated to affect around 20,000 packaging producers and importers doing business there. According to government figures, this will generate approximately £235-million in revenues in its first year, although there is no clear indication of how this will be spent. In a perfect world, this would go towards research and development in helping companies transition away from single use plastics, or packaging with a low level of recycled polymers, as well as funding grants to help businesses adopt closed loop recycling systems. The tax is expected to generate up to £905-million by 2026.

Widespread bans

Other countries like Italy and Spain are also in the process of introducing their own tax laws on single use plastics at a local level, while Germany, France, Sweden, Estonia, Malta, Greece, Ireland and a host of other countries have banned single-use plastics entirely. Experts have often said that improved extended producer responsibility schemes (like the example set by Belgium) can help reach the targets set out in the EU’s plastic strategy and boost plastic recycling across the continent to reach the high recovery levels of metals and glass.

North America

Plastic’s legal landscape in North America is more complex and less uniformed. A patchwork maze of bills and proposals that is constantly evolving in different states, is developing under an umbrella of national legislation that has kept the US in particular behind legislation in Europe. As one of the largest producers of plastic in the world it has one of the worst recycling rates, although this varies considerably from state-to-state as explained perfectly by Robet Lilienfeld in his article about different PET recycling rates in the USA.

“There are 10 states with bottle bills, or deposit laws, in the United States. The collective recycling rates for these states is approximately 54%, about double for the country as a whole,” he writes. “You’ll note that three of the four states with the highest recycling rates (CA, MI, OR) have deposit amounts in the 10¢ per bottle range. Maine, the state with the nation’s highest recycling rate of 78%, has a 5¢ rate on typical bottles, but a 15¢ rate for alcohol bottles.”

Unifying EPR regulation, he argues, would be a logical first step to leveling up recycling rates across the country. For now the patchwork approach continues as some controversial bills make their way through congress.

Break Free From Plastic Pollution Act 2021: Arguably the biggest and most aggressive legal framework proposed to date, this act would phase out a variety of single-use products, such as plastic utensils, as well as put methods in place to encourage their reduction by 1 January 2023. In 2019, figures showed that the US exported 225 shipping containers of waste per day to other countries with extremely poor or non-existent waste management systems. The BFFPPA establishes limitations on these exports, and building on other successful statewide laws, represents the most comprehensive set of policy solutions to the plastic pollution crisis ever introduced in Congress.

EPR laws in the US

Across the country, groups are increasing their focus on passing EPR laws to shift recycling costs away from taxpayers and placing greater responsibility onto producers. Here’s a brief snapshot of what’s happening so far in each applicable state:

- California (SB 54): Aims to achieve a 75% source reduction, recycling, and reuse goal. Proposal in place to make businesses financially responsible for management and recovery of plastic waste. Plastic containers to include at least 30% recycled material by 2030. Last amended on 25 February 2021.

- Colorado (HB22-1355): Passed EPR laws on 2 June 2022, the third to do so in the US. Producers of packaging and printed paper will fund and operate the program, expected to go into effect in 2026.

- Hawaii (HB 1316): Still in draft phase. Producers would be required to submit annual reports showing how they take responsibility for waste while ensuring minimal social and environmental impact. Local Department of Health would determine payment structures.

- Maine (LD 1541): Became the first EPR program signed into law on 13 July 2021. Covers most types of consumer packaging and will require producers to make payments to a stewardship organization. Also includes eco-modulation system to incentivize companies to create packaging that’s easier to recycle and reuse.

- Maryland (HB 36): At this stage, producers of certain packaging, containers and paper products are required to submit a stewardship plan to the Maryland Department of Environment by October 2022. Producers would be prohibited from selling those products without this approved plan by 2024.

- Massachusetts (HD1553): Goal to establish a producer responsibility organization (PRO) and submit a stewardship plan for how the PRO will run the program and reimburse collectors. A new draft was entered on 6 June 2022. Stakeholders to form advisory committee and allow producers to propose alternative collection programs for certain packaging.

- New York (S1185): Could mandate that producers cannot sell or distribute “covered materials” without an approved plan within three years of the bill’s passage. Certain producers would be exempt under certain revenue and waste generation thresholds. Reported and committed to finance department on 25 April 2022, but was not included in final state budget for the financial year.

- Oregon (SB 582): The second EPR bill to be signed into law on 9 August 2021. Most packaging producers will need to sign up to a PRO, and this PRO must submit an EPR plan to Oregon’s Department of Environmental Quality by March 31, 2024.

- Washington (SB 5022): The bill calls for EPR to assist in supporting the state goal of ensuring 90% of packaging materials are reused or recycled by 2040.

Bans on single-use plastic bags:

Currently eight US states have banned single-use plastic bags – California, Connecticut, Delaware, Hawaii, Maine, New York, Oregon and Vermont.

In New Jersey, the senate passed the Recycled Content Bill (S2515/A4676) on 10 January 2022, stipulating that plastic containers and bottles must consist of 10-15% recycled material within two years, increasing to 50% at a date to be determined.

Check back here regularly as we update this information as it develops in the coming months and years.

Central & South America

Single-Use Plastics Bans

Chile is leading the way in South America, becoming the first country on the continent to fully ban single-use plastics like straws, plastic cutlery and styrofoam food containers under Law 21368, passed on 6 August, 2021. Chile is also planning to ramp up legislation to mandate returnable bottles in stores and warehouses by August 2023, as well as make it compulsory for restaurants and takeaway spots to only use recyclable or reusable containers and cutlery by 2024.

Mexico City, one of the world’s biggest cities, started 2021 with a bang by banning single-use plastics in an effort to close the loop on waste.

In Brazil, environmental organizations like Oceana and UNEP are ramping up campaigns to abolish single-use plastics throughout the country. In August 2021, they struck an agreement with Brazil’s largest food delivery platform iFood to phase out their supply of single-use plastics. iFood has also pledged to increase its share of reusable packaging starting in 2023, as well as ensure that 80% of its deliveries do not include napkins, plastic cutlery, plates, cups and straws by 2025.

In December 2018, Peru took the first steps towards eliminating single-use plastics in the country by passing law 30884, regulating the manufacture, import, distribution and consumption of these products. The law also enforces a tax on plastic bags and requires that plastic bottles contain 15 percent recycled materials.

Elsewhere, Colombia implemented a plastic bag tax and EPR laws that state producers must collect and process at least 10% of material they put on the market. Legislation to ban single-use plastics types including Icopor, plastic straws, bags, and other types of packaging.

Incentives law passed in Panama

Law 223 was published in Panama’s Official Gazette on June 8 2021, providing a legal framework to establish environmental tax exemptions for the country’s highly informal recycling industry, in an effort to promote sustainable business practices and attract recycling companies to set up business there. The law took effect in 2022, with Article 4 detailing that “… natural and legal persons that reconvert their activity, replacing their plastic products with biodegradable materials that do not contain plastic, and are duly endorsed by the Ministry of Environment will enjoy the following benefits for a period of five years: 1) Exemption from import taxes on equipment and machinery; 2) 15% discount of the income tax.”

One of the major challenges for the Central and South America region has been access to effective recycling infrastructure, and in some countries it’s simply non-existent, relying on informal recyclers to recover the material. While improvements are being made in places, it remains a weak link in the recycling and waste management chain, presenting massive opportunities for investment in the region.

Asia

China: Operation National Sword

China’s decision to stop importing and processing waste from other countries in 2017 under the legislation of Operation National Sword was perhaps the catalyst for many of the regulations introduced elsewhere. The new policy energized America’s recycling industry overnight, prompting large scale investments in chemical and traditional mechanical recycling facilities. Between 2010 and 2018, the US had exported more than 15.2 million metric tons (or nearly three million large shipping containers) of waste to countries with poor waste management systems, meaning that much of it ended up being poorly processed. Over 12 million metric tons of that went to China.

As a result of National Sword, recycling infrastructure has boomed within exporting countries like the US, as well as a host of new recycling policies introduced to cope with the buildup of waste. In the first year following its implementation, plastic imports to China dropped by 99%. China itself also introduced strict laws to manage its own domestic waste, and several tech firms have even begun to introduce interesting AI solutions in the waste sorting push.

Shanghai-based company Alpheus, for example, is using facial recognition and cloud technology to assist the city’s compulsory waste sorting law, creating smart bins with cameras that automatically organize waste as soon as it’s thrown away. The tech is yet to be implemented on a mass scale, but is already 95% accurate and can be deployed in a variety of new products.

Japan and Thailand cut back on Disposable Plastic

As of 1 April 2022, retailers, restaurants and other similar businesses in Japan are required by law to reduce the use of 12 types of disposable plastic products, or face the possibility of stiff fines. However the new law does not uniformly regulate reduction targets, and specific reduction measures have largely been left to businesses. Hotel chain Super Hotel Co. is one of many companies that has taken the new laws to heart by cutting back on plastic, like stopping the supply of toothbrushes in rooms.

Meanwhile in Thailand, single-use plastic bags were banned at the start of 2020, reducing the use of plastic bags by roughly 2 billion, or about 5,765 tons in the same year.

A “Total Ban” in India

According to the Central Pollution Control Board, India produces about 25,000 tons of plastic waste every day, making it one of the biggest plastic polluters in the world. The Indian government has recognised this however, and in a major move announced last year, all manufacture, sale and distribution of single-use plastics will be banned as of 1 July 2022. This will be implemented in a phased approach, with smaller plastic products like earbuds and plastics used in candy packaging and balloons being the first to go. The Environment Ministry is also pushing for the formulation of effective EPR laws in the country to further curb the rampant plastic problem.

Australasia

Saying goodbye to Single-Use Plastics in Australia

New South Wales passed the hugely encouraging Plastics and Circular Economy Act 2021 in November last year, outlining how single-use plastics would be phased out as of June 2022. This legislative framework seeks to do this through setting design standards, with the first of these targeting microbeads in cosmetic and personal care items, ensuring they are phased out from 1 November 2022.

Additionally, the government plans to spend AUD$356-million over the next five years on the NSW Plastic Action Plan, which is expected to stop 2.7 billion single-use items from ending up in the natural environment and waterways over the next 20 years.

NSW is just one of seven Australian states that has banned single-use materials, showing the country’s commitment to a future free of harmful plastics. Check out this report card detailing which states have banned, or have committed to ban, single-use plastics and by when.

Under Australia’s National Plastic Plan released in 2021, plastic containers must include at least 20% recycled material by 2025.

Going “Clean Green” in New Zealand

With legislation passed in 2021, New Zealand took a stand to live up to its “clean green” reputation by banning harmful products like PVC meat trays, polystyrene takeaway packaging and other plastic products in a phased approach, starting in 2022. By mid-2025, all other PVC and polystyrene food and drink packaging will be outlawed, as well as a range of single-use plastics like straws, cutlery and cotton buds.

Environment Minister David Parker estimated that the new policy would remove more than 2 billion single-use plastic items from landfills or the environment each year. New Zealand also passed legislation to ban plastic bags in 2019.

Challenges for PET industry

The challenge for the PET value chain is to support the achievement of present and future recycling targets in the most ambitious countries that have set their sights set on a “waste-free world”, while being cognisant of the shift in rPET demand across all packaging applications.

This means maintaining and increasing the availability of high quality rPET material that will, in turn, enable the industry to increase the use of recycled content without processing issues, discoloration and other visual defects.

As momentum grows with single-use plastics facing regulations, reusable and recyclable plastics like PET with much higher recovery and recycling rates than single-use plastics will become increasingly valuable around the world, as governments, companies and individuals seek to reimagine a future devoid of linear consumption systems.

These legislative frameworks provide one solution in a complex puzzle of moving parts, and PET needs to play a leading role in the shift to a regenerative outcome.

Get in touch with us if you’d like to discuss your part in the plastic puzzle, and how we might work together to affect global change. And remember to check back here regularly as we update this information as it develops.

If you like this content and would like to help close the loop on plastic waste then join the AdaPETation Network by clicking on the button below.

Share it

THE HISTORY OF PLASTIC

Throughout the history of plastic, PET has been crucial in keeping food fresh with lightweight and durable packaging solutions that have helped reduce food waste for almost a century. Learn all about the invention of plastic and the important role it has played feeding people and saving the lives of humans and elephants in the adaPETation® timeline of the history of plastic.