A growing group of powerful investment funds have spotted an opportunity to finance the transition to full circularity, backing the solutions that will close the loop on plastic waste.

Closing the loop on plastic waste is one of the biggest systemic challenges that we face as a species. Plenty has been written throughout the history of plastic, about the problems associated with our collective failure to manage the material and to close the loop on plastic pollution posed to society.

There are other problems that need to be addressed at the same time such as greenhouse gas emissions and while plastic is currently contributing to that issue too — as one of the lightest and most flexible materials available to use — it has an important role to play in fighting the climate crisis.

Where the two problems of greenhouse gas emissions and plastic waste coincide in one neat solution is the area of circularity and yet investments in circular solutions are not being rolled out with the speed required. Not yet anyway.

There are positive signs that as institutional investors place greater pressure on corporations to address the growing risks associated with plastic waste, a pool of impact investors have spotted an opportunity to focus on circularity as a pathway to both financial and environmental gains.

What Isn’t Measured Cannot Be Managed

Keeping track on where more investment is needed and also where gains have been made is the objective of a recent initiative by The Circulate Initiative — which is backed by some of the world’s biggest plastic producers.

The Circulate Initiative launched the world’s-first investment tracker for plastics circularity, providing unique insights into the scale of investments into plastics circularity, the types of solutions, and regions receiving funding.

This investment tracker is a tool for investors to help them assess where capital is needed most and to better identify opportunities that offer the potential to unlock financial returns as well as positive environmental and social impact.

By bridging existing data gaps and improving the transparency around the financing of plastics circularity solutions, the Investment Tracker will enable investors to make better-informed decisions for a sustainable future.

Investment funds are one of the most effective ways to make sure that the money is being put to use in the most effective way. These funds are designed to target specific areas, such as plastic waste reduction, and provide money to companies and organizations that are working to reduce plastic waste. One example was the establishment of a $500m investment fund to be managed by Lombard OIM in May last year.

“The systemic transformation needed to enable a plastic circular economy requires societal, infrastructure and technology innovations,” says Jim Fitterling, Chairman and CEO of chemicals giant Dow and the chair of the Alliance to End Plastic Waste. ”This strategy presents a meaningful opportunity to put the plastic waste management ecosystem firmly on the agendas of institutional investors to accelerate the transition to a global plastic circular economy.”

Being Good to the Planet is Good Business

Another fund seeking to incentivize the shift towards circularity is AXA Investment Managers which set up a fund to invest in companies reducing plastic waste in January 2023.

Jonathan White, head of investment strategy & sustainability in AXA IM Equity QI team, explained why at the time: “Companies that are reducing waste and supporting a more sustainable approach to their use of plastic play a key role in the effort to mitigate climate change and stem biodiversity loss. We expect the next few years to be pivotal in plastics pollution mitigation driven by both government regulation and changing end-consumer preference. These structural trends are likely to drive significant growth in segments of the markets such as sustainable packaging and plastic recycling. As such its our view that companies that are facilitators or leaders in waste management and plastic-use are not only sustainable investments but could also be an attractive long term investment opportunity.”

There are a handful of important players driving the transition with regulatory pressure accelerating the process and flow of capital. The investment funds highlighted in this article are all focused on reducing plastic waste, and each one has its own unique approach to the problem. They are all making a significant impact in the fight against plastic waste, and their efforts are helping to create a more sustainable future.

There are indications that private equity, principally supported by the world’s largest producers, is being joined by institutional investors – highlighting a shift in the investor profile.

Circularity Holds the Answers

With the right investments and the right strategies, Circulate estimates “an 80% reduction of ocean plastic leakage is possible by 2040 through the use of existing technologies if we combine upstream and downstream solutions to achieve system change.”

Early market research by investment firm Circulate Capital also highlighted the need to strengthen the pipeline of investment-ready solutions in waste management and plastic recycling, and improve access to the right tools and knowledge to guide decision-making and investment in emerging markets.

The Circulate Initiative launched its Plastics Circularity Investment Tracker in March 2023, highlighting how approximately US$850 million was invested annually in plastics circularity solutions across emerging economies. This was, however, significantly lower than the estimated US$27.5 billion a year needed to fund basic waste management infrastructure in these markets. The total investments made between 2018 and 2022 was estimated at US$4.1 billion showing both the shortfall and the enormous opportunity to investors.

The Circulate Initiative’s Research Director, Umesh Madhavan, says, “Global attention towards the plastic waste crisis, corporate commitments and growing consumer demand for sustainable products are creating a unique moment in time for investment into circular solutions. Investors can help to pave the way for a circular economy, but to date they have lacked the tools and data to assess where capital is needed most.”

By bridging existing data gaps and improving the transparency around the financing of plastics circularity solutions, Madhavan adds that the Investment Tracker will enable investors to better identify opportunities offering the potential to unlock financial returns as well as positive environment and social impact.

The accompanying insights report “The Plastics Circularity Investment Tracker: Monitoring Capital Flows to Tackle the Ocean Plastic Pollution Challenge” also exposed the disproportionate distribution of capital across the plastics value chain, with 88% of investments allocated to downstream solutions such as recycling and recovery.

While continued investment in plastic waste management is necessary to prevent further leakage, the findings highlight the need for more equitable distribution of funding to the reduction and avoidance of plastics to achieve system change.

Additional findings from the report include:

- The top 10 deals in plastics circularity involved waste management or recycling companies, indicating that investors tend to be risk averse when evaluating circular solutions and prefer established and tested practices and business models.

- Asia is leading the way in plastics circularity financing, receiving 87% or US$3.5 billion of cumulative investments since 2018.

Here, we’ve highlighted some of the most active players. Each of these funds has made a significant impact in the battle to contain plastic waste, and their efforts are helping to create a more sustainable future. By investing in these funds, individuals and organizations are helping to make sure that the money required to reach circularity starts to flow.

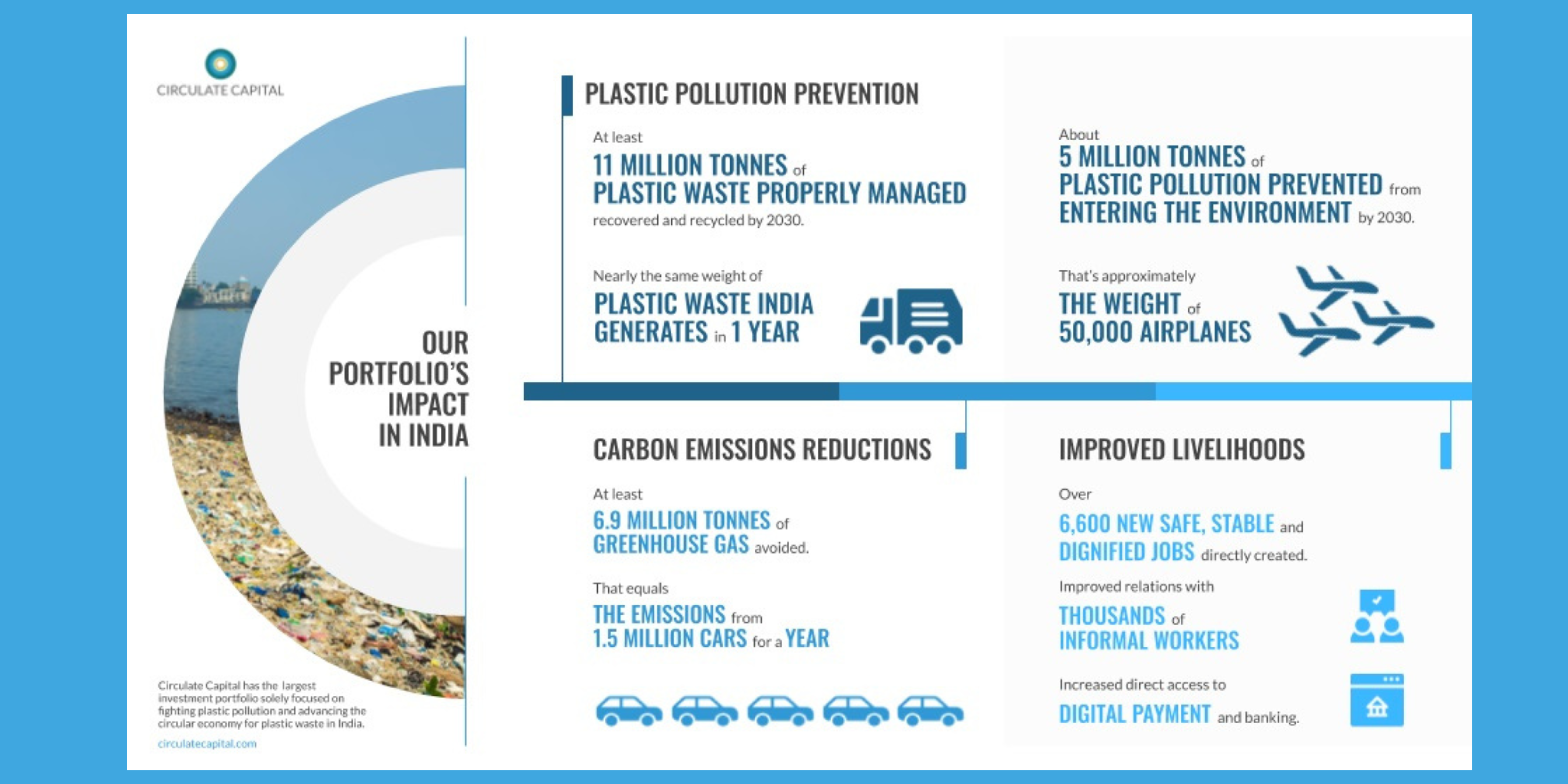

Circulate Capital

Circulate Capital is the leading circular economy investment management firm in high-growth markets. Launched in 2018 to invest in solutions for the ocean plastic crisis in South and Southeast Asia.

The fund has since broadened its investment focus to plastic circularity, including disruptive innovations across value chains, throughout the world’s high-growth markets. Circulate Capital has invested in high-potential companies that divert plastic waste from landfills and toward a circular future.

Created in partnership with leading global corporations including PepsiCo, Procter & Gamble, Dow, Danone, Chanel, Unilever, The Coca-Cola Company, Chevron Phillips Chemical Company LLC and Mondēlez International, Circulate Capital has committed to investing half of its US$112 million Circulate Capital Ocean Fund (CCOF I) into India, and today has the largest portfolio dedicated to fighting plastic pollution and advancing the circular economy in the country. The fund’s activities are complemented by the US$53 million Circulate Capital Ocean Fund I-B (CCOF I-B), which acts as a companion venture and private equity fund to CCOF I.

Circularte Capital partners with global brands and institutional investors plans to invest up to USD$1bn in solutions that catalyze systems change across the globe. Its financing transforms circular plastic supply chains at scale, delivering competitive financial returns and positive impact.

CCOF I-B’s latest close brings Circulate Capital’s total assets under management to US$165 million, making it the largest impact investment firm dedicated to fighting plastic pollution and advancing the circular economy in South and Southeast Asia. Alongside the firm’s US$112 million Circulate Capital Ocean Fund (CCOF I), the fund invests in companies across the plastic-recycling and waste-management value chains, as well as startups focused on early-stage disruptive innovation and technology aligned with Circulate Capital Disrupt, the firm’s climate tech strategy, such as new delivery models, advanced recycling technologies, and new alternatives to single-use plastic. https://www.circulatecapital.com/

Companies working on reducing plastic waste in their portfolio:

Recykal

India’s first waste-commerce company, Recykal, is providing cutting-edge end-to-end digital solutions supporting a sustainable recycled plastic supply chain in India. Recykal facilitated the recycling of nearly 3,000 metric tonnes of plastic waste in 2021 alone. While currently focused on plastics and e-waste, Recykal’s circular economy solutions have also facilitated the proper management of more than 130,000 tonnes of other recyclable materials, including paper and steel. Circulate Capital invested in India’s Recykal in December 2020 and the company raised an additional $22M, including investment from Morgan Stanley – highlighting Circulate’s role as a catalyst for future investment. Recykal.com

Srichakra Polyplast (India)

Founded in 2010, Srichakra Polyplast produces superior recycled PET and olefin flakes and granules for the packaging industry, helping brand-owners reduce their use of virgin plastic. Since Circulate Capital’s initial investment in 2020, the company has increased its capacity sixfold, has commissioned India’s first of its kind bottle-to-bottle recycling facility and has become the first Indian recycling company to receive a positive safety assessment from the European Food Safety Authority (EFSA). https://srichakra.in/

Lucro Plastecycle Private Limited (Lucro)

A homegrown Indian manufacturer that specializes in recycling difficult-to-manage flexible plastic packaging. Established in 2012, the company specializes in recycling locally sourced plastic waste to manufacture flexible packaging products. Today, the company is the largest supplier of post-consumer recycled flexible plastic products like shrink wraps, stretch wraps, polybags and other flexible packaging to FMCG, F&B, retail, fashion, automotive and electronics industries. Since Circulate Capital’s initial investment in 2020, Lucro has increased its capacity more than tenfold. In February 2021, Lucro and Circulate Capital investor Dow entered into a memorandum of understanding to co-develop a post-consumer recycled polyethylene film solution. Read more about this partnership. https://www.lucro.in/

Tridi Oasis

Tridi Oasis is an Indonesian, female-led company specializing in recycling PET bottles into rPET flakes, which are used in the production of packaging and textiles. Working closely with local and international partners as well as local communities to advance the circular economy, create more sustainable jobs for Indonesians along the waste management value chain and create a positive impact on the environment, they are also collaborating closely with their network of suppliers on the traceability of the materials they recycle. Circulate Capital Ocean Fund invested in the company in 2020 and in August 2022, Tridi Oasis partnered with ALBA Asia Plastics Recycling Limited – a leading global recycling specialist and environmental services provider, through a Joint Venture, marking it Circulate Capital’s first exit.

http://www.tridi-oasis.com/

Prevented Ocean Plastic Southeast Asia

An Indonesian plastic waste collection company that is pioneering an innovative supply chain model across Indonesia. A unique partnership announced in January 2022 between PT Polindo Utama, Bantam Materials Ltd and Circulate Capital, Prevented Ocean Plastic Southeast Asia sets up best-in-class collection infrastructure to coastal communities across Indonesia that have limited or no collection today, to prevent plastic leakage and support local livelihoods. It combines the unique strengths of each partner to deliver localized infrastructure providing certified and traceable premium quality recycled plastic to global markets, driving environmental, social and economic value from the bottle collector to the end consumer. Thanks to Circulate Capital’s investment, the company is establishing new high-volume collection centers and aggregation centers in coastal communities across Indonesia. https://www.preventedoceanplastic.com/

Dalmia Polypro Industries (Dalmia)

Dalmia is a sustainability-focused plastic recycling company that produces high-quality recycled materials from local PET and Polyolefin waste for reuse in fashion and packaging applications. With a strong focus on innovation and technology, the company is one of the largest PET flake and polyolefin granules recycler in India and leading the way in the development of food-grade applications in the market.

https://www.dalmiapolypro.in/

Closed Loop Partners

Closed Loop Partners is a New York-based investment firm that is focused on building a circular economy, principally in the USA. It has US$530m in its different funds and has invested in 65 companies that are working to reduce waste, including plastic waste. The different funds include: the Ventures Group which has been injecting early-stage capital into companies developing breakthrough solutions for the circular economy since 2016. Its Closed Loop Circular Plastics Fund deploys catalytic financing into sustainable technologies, organizations and projects that advance the recovery and recycling of plastics in the U.S. and Canada. All of its investments aim to increase the amount of recycled plastic available to meet the growing demand for high-quality, recycled content in products and packaging.

Closed Loop Partners

https://www.closedlooppartners.com/

Companies working on reducing plastic waste in their portfolio:

Algramo

Algramo builds a “smart dispensing system” for CPG products that incentivizes the reuse of packaging, and provides an economic benefit to buyers (able to buy small quantities of products at bulk prices), retailers, and brand owners. https://algramo.com/

AMP Robotics

Changing the economics of recycling with industrial AI and robotics, AMP is an artificial intelligence and robotics company developed by a CalTech PhD, focused on increasing the quantity and quality of sortation processing at recycling facilities. AMP Robotics uses state-of-the-art computer vision and robotics that rapidly identifies and recovers material from the waste stream to improve the quantity and quality of recycled commodities recovered from co-mingled waste streams. https://www.amprobotics.com/

Greyparrot

Greyparrot is a leading AI waste analytics platform for the circular economy. By deploying their AI Waste Recognition System globally on moving conveyor belts in sorting facilities, their mission is to increase transparency and automation in recycling to unlock the financial value of waste by improving the quantity and quality of recycled commodities recovered from co-mingled waste streams. https://www.greyparrot.ai/

Myplas

South African recycler Myplas launched its first operations in Minnesota. Their target 170,000 square-foot plastic recycling plant will be located in the city of Rogers, 25 minutes northwest of Downtown Minneapolis. Each year, its 170,000-square-foot recycling plant will recycle nearly 90 million pounds of low- and high-density polyethylene packaging and film. The Myplas mission is to build a circular economy for plastic films and packaging materials in the US, reducing greenhouse gas emissions and curtailing waste. In collaboration with a regional coalition of major businesses that use flexible film, its is launching its US operations in the Upper Midwest. With a new state-of-the-art plant in Rogers, Minnesota, Myplas USA is expanding flexible film recycling infrastructure and the supply of recycled resin for some of the region’s most high-volume users of film products. https://myplasusa.com/

Sims Municipal Recycling

A global leader in recycling and sustainability, SMR is one of the largest privately held recycling companies in the world. The Closed Loop Leadership Fund led a consortium of investors, including the Partnership Fund for New York City, in acquiring a majority stake in Sims Municipal Recycling (SMR). The acquisition is expected to further modernize circular economy infrastructure and service in the New York-New Jersey Metro region and Florida, as well as expand SMR’s best-in-class operations into new markets. This was the first investment from the Closed Loop Circular Plastics Fund, Closed Loop Partners’ catalytic flexible financing fund. https://smrecycles.com/

Balcones Resources

Balcones Resources became the Closed Loop Leadership Fund’s inaugural investment in October 2019. Balcones Resources is the largest privately held recycling company in Texas, providing recycling service to Austin and Dallas since 1994. The fund followed its private equity investment with an investment to create the first artificial intelligence-powered recycling company in the US, focused on processing recyclables from residential and commercial single-stream programs within the Florida market. Single Stream Recyclers – a single-stream material recovery facility (MRF) in Sarasota, Florida sorts recyclable materials that are collected through residential and commercial recycling programs. The facility can process up to 50 tons of recyclable material per hour. In August of 2020, Balcones Resources, acquired SSR, to continue to grow its footprint of best-in-calls recycling facilities in the South. For more information about Balcones Resources and the partnership with Closed Loop. https://www.singlestreamrecyclers.com/ https://www.balconesresources.com/

Evergreen

Evergreen, a plastics reclaimer and rPET manufacturing facility, will be the next recipient of a significant investment under the beverage industry’s Every Bottle Back initiative. The US$5m investment – half from the American Beverage Association in partnership with Closed Loop Partners and the other half from Closed Loop Partners’ Infrastructure Fund – will help Evergreen evolve its business model, expanding its services to process recycled PET plastic into food-grade recycled rPET pellets used to manufacture new bottles, while creating a strong local market for recycled plastics. https://www.evergreentogether.com/

Ann Arbor

The City of Ann Arbor, through a loan provided to Recycle Ann Arbor by Closed Loop Partners and the American Beverage Association, began rebuilding a zero-waste MRF in August of 2020, to strengthen the resilience of the city’s recycling system. The targeted investment of US$800,000, deployed in partnership with Closed Loop Partners, will help enhance the sorting of valuable recyclable materials, like the beverage industry’s 100% recyclable polyethylene terephthalate (PET) plastic bottles. https://www.recycleannarbor.org/

ABC Impact

The private equity arm of Temasek Holdings raised US$300m to focused on impact investment and aims to be the leading impact investment firm in Asia by fostering innovative and resilient companies that deliver societal and environmental benefits. So far it has been focused on addressing pressing environmental and social challenges in Asia and reframe them into growth and development opportunities. They are investing in climate solutions that mitigate climate change, reduce pollution and improve environmental conservation for the planet. https://abcimpact.com.sg/

Companies working on reducing plastic waste in their portfolio:

Polymateria

The company led a £20m Series-B investment with Indorama Ventures in 2023. Polymateria provides a tailored biodegradable solution for conventional plastic packaging, aiming to stem the global plastic pollution endemic. The company’s scientists have created a proprietary technology that can break down plastics safely if they escape into the environment. Our technology is time controlled, meaning we can tailor this to the product’s service life to enable maximum opportunity or the packaging to be recycled. https://www.polymateria.com/

Archipelago Eco Investors

Investing in the Circular Economy to support transformation of the plastics sector. A new approach to impact investment throughout the plastics landscape. The Future of Plastics Fund is a late stage Venture Capital Impact Investment Fund enabling SMEs in Europe to build and scale up Circular Economy technology solutions within plastics supply chains. The Future of Plastics Fund is looking to achieve a First Close in late 2022 and a final close of €100m targeted in 2023. The fund is designed to support technologies that address key barriers for plastics in the Circular Economy, enabling them to transition from pilot phase to growth across the life of the Fund. AEI provides investors with attractive financial returns, and access to a portfolio of outputs and technologies addressing different types of plastics, recycling approaches, scales and displacement methods within circular supply chains.

Companies working on reducing plastic waste in their portfolio:

Greyparrot AI

The Accelerating Growth Fund Ltd (AGF), a subsidiary of climate action NGO WRAP, made its first key investment on behalf of the Future of Plastics Fund, a new Circular Economy impact fund being established by Archipelago Eco Investors to focus on the interlinked issues of plastic waste and climate. Greyparrot AI, who’s innovative Artificial Intelligence (AI) Waste Recognition System automates waste composition analysis and the monitoring, auditing, and sorting of waste flows at scale in the UK, Europe and globally. The Accelerating Growth Fund Ltd will ‘warehouse’ the investment until the Future of Plastics Fund reaches a ‘first close’, later this year.

Founders Factory

Formerly Sky Ocean Ventures, the investment arm of Sky, a UK-based media company. The Founders Factory fund invests in companies that are developing solutions to plastic waste, with a particular focus on ocean plastics. One of its portfolio companies is Polymateria, which is developing a biodegradable plastic that breaks down naturally in the environment. https://foundersfactory.com/

Ecosystem Integrity Fund

The Ecosystem Integrity Fund is a San Francisco-based venture capital firm that invests in companies working on sustainability solutions. https://eif.vc/portfolio/

Companies working on reducing plastic waste in their portfolio:

Synovapower

Innovative waste-to-energy project developer that converts garbage and biomass into clean syngas for use in power generation. Proprietary gas cleaning technology and proven system components enable better environmental performance and dramatically reduced capital costs Potential to dominate the global market for small/medium-size waste-to-energy projects Currently developing global pipeline of projects with initial concentration of projects in Southeast Asia www.synovapower.com

Amazon Climate Pledge Fund

The Climate Pledge Fund was established to support innovative climate technology companies with the most potential to help Amazon and others reach net‑zero carbon emissions by 2040. This dedicated program—with an initial US$2bn in funding—invests in visionary companies with a potential for long-term impact. Companies working on reducing plastic waste in their portfolio:

Genecis

Amazon’s program also invests money in incubators and accelerators that support women entrepreneurs, and it’s designed to help address the gender-equity funding gap that currently exists for women in climate tech. It recently announced its Female Founder Initiative to invest USD$50 million in women-founded and women-led climate tech companies. One of its first investments was to back Genecis, a bioplastics company founded by scientist Luna Yu. Genecis uses organic waste, like table food scraps, to create a biodegradable bioplastic that is an alternative to conventional plastic packaging. Yu, who founded Genecis at the age of 21, is the first woman CEO to receive investment support through the Female Founder Initiative. Genecis is also the fund’s first investment in a company directly addressing the use of fossil fuel–derived plastics and the global warming factors they contribute to. https://www.genecis.co/

Lombard Odier Investment Managers

The Alliance to End Plastic Waste (“Alliance”) and Lombard Odier Investment Managers (“LOIM”) announced in May 2022 their intention to launch a new circular plastic fund. The fund will aim to raise US$500m from institutional and other accredited investors for scalable solutions to remove plastic waste from the environment, increase recycling, and drive the global transition towards a circular economy for the plastic value chain. The Alliance — which was founded by Dow Chemicals and other major plastic producers — will serve as a cornerstone investor in the fund. https://endplasticwaste.org/en/news/new-fund-will-target-plastic-waste-as-an-investible-opportunity

AXA Investment Management

AXA Investment Managers (AXA IM) announced in January 2023, the launch of the AXA WF ACT Plastic & Waste Transition Equity QI fund which supports, on the long-term, the United Nations Sustainable Development Goals (UN SDGs), in particular the SDG12, Responsible consumption and production, by investing in companies that are limiting or managing in a sustainable way their plastic use or have efficient waste management practices. Managed by the AXA IM Equity QI team, responsible for AXA IM’s quantitative equity capabilities, the fund invests in companies that are UN SDG12 aligned, for example through the actions they are taking in their operations, such as production processes, recycling rates and supply chain management, to limit or manage in a sustainable way their plastic and waste footprint or because the company provides products that directly support responsible consumption and production. The fund invests in large, mid and small cap companies across developed and emerging markets. The selection and weightings of the stocks is based on a proprietary quantitative process that incorporates both financial and non-financial data with the objective of identifying fundamental drivers of risk and return whilst structuring the portfolio in a way that meets the fund’s SDG objectives. As an example, the management team uses Natural Language Processing (NLP) to increase exposure to companies that are actively articulating a plastic or waste approach in their earnings calls.

Yunus Environment Hub

Yunus Environment Hub is the Global Social Business Network Creating Solutions for the Environmental Crisis. While it doesn’t invest directly in companies it does help social enterprises find investors by preparing them to pitch to funds and investment partners within its network. Targeting the issue of global plastic waste leakage, Yunus Environment Hub has developed a modular social business approach. Through the development of local social businesses, municipal waste management systems in developing countries highly affected by plastic waste leakage are strengthened. Run by teams of local entrepreneurs and staff, all social businesses founded during the course of the program increase the amount of locally collected and recycled plastic waste while providing income opportunities to informal waste pickers and improving local livelihoods. https://yunusenvironmenthub.com/

Initiatives working on reducing plastic waste in their portfolio:

ValuCred

ValuCred is a consortium led by Yunus Environment Hub, Nehlsen AG and Rodiek, and BlackForest Solutions, for the design and financing of sustainable plastic waste management systems. The ValuCred project is one of the first promoted by PREVENT Waste Alliance with funding from the Federal Ministry for Economic Cooperation and Development (BMZ) and the Röchling Stiftung for the development of an international Standard Process Model (SPM) that aligns and connects interdependent stakeholders in the ‘Plastic Credits’ market. Bringing radical transparency into the generation and valorization of Plastic Credits, ValuCred empowers informal waste workers in low-income countries whilst striving for zero plastic leakage into the environment. https://yunusenvironmenthub.com/valucred/

Grameen Precious Plastic

In joint collaboration with the open source project Precious Plastic, Grameen Telecom and Yunus Environment Hub set up a pilot recycling workspace in Dhaka, Bangladesh to engineer products from recycled plastic. After a successful pilot project, the program shall be introduced in different parts of Bangladesh through the incubation of new entrepreneurs of the so-called “Nobin Uddokta Program” to create employment opportunities as well as the manufacture of recycling machines in the country. The program features:

(1) the setup of plastic recycling and manufacturing,

(2) training young adults on working with plastic waste and the respective machinery to manufacture products,

(3) designing and testing innovative products made from secondary materials as well as

(4) supporting informal waste pickers who collect the plastic waste. https://www.onearmy.earth/moments/precious-plastic-meets-yunus-muhammad

If you found this content useful sign up to the adaPETation® Network and share with us what we should be doing to bring solutions together in the United Nations Decade on Ecosystem Restoration.

Share it

THE HISTORY OF PLASTIC

Throughout the history of plastic, PET has been crucial in keeping food fresh with lightweight and durable packaging solutions that have helped reduce food waste for almost a century. Learn all about the invention of plastic and the important role it has played feeding people and saving the lives of humans and elephants in the adaPETation® timeline of the history of plastic.