Should we really be turning bottles into feel-good fashion and packaging it as a silver bullet for the $1.7trn industry’s image problem with socially-conscious customers?

Always fast to catch on to trends, the fashion industry has been lauded for a shift towards sustainability in recent years. A herd of fashion brands have proudly announced their transition to using recycled polyester (rPET) as a key pillar of their eco-friendly initiatives.

The eco-friendly narrative being hoisted upon socially-conscious fashionistas is compelling: by converting millions of discarded plastic bottles into wearable textiles, the industry is tackling the dual crises of plastic pollution and unsustainable fashion.

Labels across the industry regularly point to the number of bottles diverted from landfill in each item of clothing.

However, on closer examination, it’s a far less flattering story with serious flaws stitched into its logic. Namely the host of hidden costs of recycled polyester, shedding light on the myth being promoted by a wasteful fast fashion industry with an image problem to worry about.

The Allure of Recycled Polyester

Not unlike the packaging sector, the fiber industry feeding fashion brands with the raw material for its creations is home to healthy competition between materials ranging from cotton, polyester, wool, silk and nylon.

By far, the most popular fiber is polyester, making up 54% of total global fiber production in 2022, according to Textile Exchange, an organization promoting sustainability in the fashion sector.

Total polyester fiber production volumes increased from 61 million tonnes in 2021 to 63 million tonnes in 2022 and this number continues to grow with demand for cheaper and more resilient products.

Within this sector the market share of recycled polyester (rPET) used in these fibers hovers around 14%-15% fluctuating depending on the price of virgin polyester feedstocks and the availability of recycled material.

The allure of rPET has been heralded as a sustainable alternative to virgin polyester, a petroleum-based fiber that dominates the fashion industry due to its durability, versatility, and low cost.

The irresistible appeal of rPET lies in its promise to reduce landfill waste, conserve petroleum resources, and lower the greenhouse gas emissions of the $1.7trn fashion business.

Brands across the spectrum, from luxury to fast fashion, have embraced rPET, incorporating it into everything from sneakers to high-end dresses, in a bid to align with the growing consumer demand for environmentally responsible products.

At first glance, household names like Patagonia, Polartec, Nike and Adidas pledging to use more recycled plastic in their clothing makes a lot of sense.

The switch to recycled polyester is an efficient choice in terms of its immediate environmental impact. It produces roughly 70% fewer greenhouse gas emissions than virgin polyester, according to Textile Exchange.

As a result the demand for recycled material is only moving in one direction with Grand View Research forecasting growth in the global rPET (recycled polyethylene terephthalate) market, driven by increasing demand for sustainable packaging and the need to reduce plastic waste in the next five years.

While the rPET industry was valued at US$9.62bn in 2020 it is expected to reach US$18.81bn by 2028, growing at a compound annual growth rate (CAGR) of 8.6% from 2021 to 2028.

Reasons for this include the growing competition for PET bottles as feedstock for both the fashion and packaging industries, systemic challenges in scaling in textile-to-textile recycling, and the growth of virgin fossil-based polyester.

Driving the growth are numerous pledges from within the industry to clean up its act.

In April 2021, Textile Exchange and the UN Fashion Industry Charter for Climate Action launched the 2025 Recycled Polyester Challenge to scale the recycled polyester market. Between then and December 2022, over 151 brands and suppliers (including subsidiaries) have signed on to the Challenge and committed to jointly increasing the global share of recycled polyester to 45% by 2025.

However, in the absence of more comprehensive recycling worldwide, none of the labeling stacks up when placed under close scrutiny.

The surge in demand for rPET has led to unintended economic and social consequences. Prices for recycled plastic have skyrocketed, outpacing those for virgin materials in some markets. This price hike is partly due to competition between industries for limited supplies of recyclable PET, as well as the costs associated with collection, sorting, and processing.

The fashion industry’s reliance on rPET has also been criticized for diverting plastic away from more efficient recycling streams, where bottles could be turned back into bottles, thus maintaining a closed-loop system.

The Reality Behind Recycling PET

The journey of a plastic bottle into a piece of clothing is not as straightforward or as green as it seems.

The process begins with the collection and sorting of PET bottles, which are then cleaned, shredded into flakes, and melted down to be spun into fibers. While this does divert some plastic from landfills and oceans, the recycling rate for PET bottles remains low, with only a fraction making it into the recycling stream.

In the US, recycling rates are hovering at 30% and while they are higher in Europe, with rates as high as 50%, the total amount of material available is far from that required for consumer goods brands and global fashion companies to achieve their shared commitments to increasing the quantity of recycled material used in their products.

Industry body NAPCOR estimates that significant increases in PET collection would be needed to match the recycled content demands of the future. To reach a widely quoted target for rPET content—25% by 2025—in all US bottles, PET recyclers would need 794,000 tonnes of collected PET or 85% more collection than in 2022. To achieve 50% recycled content by 2030 in US bottles, 1.7m tonnes of post-consumer PET feedstock would be required, which is more than three times the weight collected in 2022.

Moreover, the quality of rPET can vary, leading to challenges in creating high-quality textiles that meet the fashion industry’s standards.

As Maxine Bédat, the founder and director of The New Standard Institute, a think tank that is lobbying for new guidelines for the fashion industry, argues.

“Of the limited PET that does make it into the recycling stream, the fashion industry competes with the beverage companies, where the fashion companies downgrade the plastic into clothing, which becomes trash while the bottling industry can at least turn that bottle into another bottle again. In none of this is the fashion industry “saving” any bottles from landfills.”

Arguing that garments using recycled PET are diverting plastic bottles from landfill flies against reality and simply places more pressure on the bottle and packaging industry to achieve its own commitments to increase recycled content to 50% by 2025.

Bedat argues that both industries should be lobbying harder to improve recycling rates through the introduction of deposit return systems which is the most effective way of diverting bottles from landfill increasing recycling rates in the US from levels below 30% to 60%-70% in some cases.

“PET is a great example,” says founder of Sustainable Packaging Research, Information, and Networking Group (SPRING), Robert Lilienfeld.

“There’s a significant amount of PET that is recycled, but the driver for recycling PET, at least in the United States, is the bottle deposits and there’s an enormous difference between the states where bottle deposits exist and where they don’t. In the 10 states in the United States that have bottle deposit laws of 5¢ or 10¢ per container, the collective recycling rate is about 54%. In the area of the country where there isn’t recycling going on it’s less than half of that.”

Results, he says show that the way to bring about change is to “force consumers to change their behavior and by their behavior, in this case, what I mean is paying deposits and returning their containers or getting companies to change their behavior and to pay for systems where they’re responsible for the packaging that they produce.”

Pushing the recycling rates up through recycled content mandates and bottle deposit return schemes, are essential to avoid the fashion houses placing even more pressure on packaging’s quest for circularity.

Fashion as a Positive Force for Change

With an envious array of influencers and celebrity endorsements, the fashion industry is well placed to provide added impetus to motivate more recycling where it matters most, close to the oceans and also within the industry itself, says Bédat.

“While not diverting bottles from landfill per se, some recycled polyester producers are working on increasing collection rates. Unifi has introduced Repreve Our Ocean, which actually works on increasing the collection of plastic. In this case, plastic that is within 30 miles of oceans. If a fashion company wants to make credible claims about their recycled polyester, they should be paying for investments in increasing plastic collection, like Repreve Our Ocean does. And if they really wanted to help, they would lobby for laws that would slow the flow of plastic or, at a minimum, increase collections, like bottling deposit laws.”

The same could certainly be said of the packaging industry positioning itself as a supporter of deposit return schemes.

Studies published by Zero Waste Europe and Eunomia in 2022 pointed to the positive impact of these on recycling rates. “Of the entire PET family, bottle recycling has the most developed technology and infrastructure. In Europe, the average Collection Rate of PET bottles is estimated at 96% for countries operating DRS and 48% in countries without DRS,” says Andy Grant, Technical Director at Eunomia Research & Consulting the author of the research. The recycling rate for PET bottles overall has reached 50% in Europe. The data also showed the disruptive impact of the fashion industry on the bottle industry’s circularity.

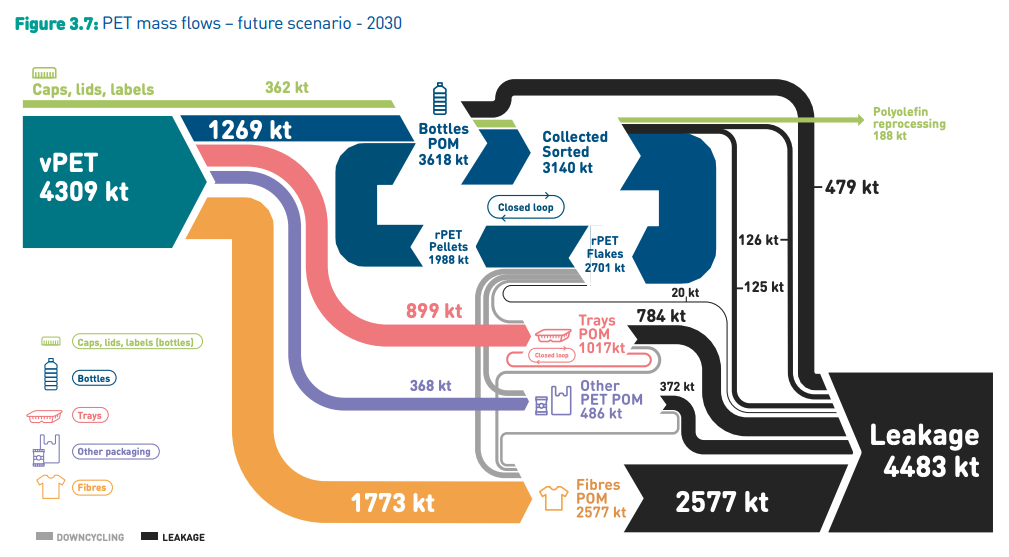

Although an estimated 50% of PET bottles are recycled to be converted into rPET, on average PET bottles contain only 17% rPET content, equating to 545 kt of rPET flakes, or approximately 540 kt of rPET pellets post extrusion losses.

This equates to 31% of the total bottle derived rPET flakes generated each year. The remainder of the rPET from bottles is used in other applications and is therefore considered a loss from the circular bottle stream. Of this leakage, 26% of the rPET derived from bottles is diverted to the fashion industry and another 31% to the production of PET trays which are more difficult to recycle than bottles.

The Need for Greater Textiles Circularity

All this points to a clear need from the textiles industry to shift away from disrupting the circularity of another industry struggling to meet its own sustainability commitments and to focus on generating more circularity of its own.

On that front, systems for textile-to-textile recycling are in development but are estimated to account for less than 1% of all recycled polyester.

Recycled polyester is still primarily made from plastic bottles (99%). The interest in, and use of, ocean or ocean-bound plastic is also increasing, but overall market shares are also still very low and make up less than 0.01% of all recycled polyester.

Similarly, the market share of bio-based polyester fiber remained very low at around 0.01% of the polyester fiber market—mainly due to issues around price, availability, and questions about the sustainability of currently available bio-based polyester.

One of the bio-based solutions under development is using fabrics made from carbon capture technologies such as that being piloted by biotech startup LanzaTech and sports apparel brand lululemon. They have teamed up to create the world’s first yarn and fabric made from captured carbon emissions. LanzaTech is working with petrochemical manufacturer India Glycols Limited (IGL) and Taiwanese textile producer Far Eastern New Century (FENC) to convert ethanol into polyester.

LanzaTech currently collects its raw materials from steel mills in China and other heavy polluting industries. The technology is far from being ready to scale to the levels required to make a significant dent in the industry’s reliance on recycled bottles.

Until it can do something to shift the dial on this, the narrative that positions recycled polyester as a sustainable solution while overlooking the complexities of global recycling systems, the limitations of current technologies, and the ongoing challenges of microfiber pollution looks to be built on shaky ground.

While rPET does offer some environmental benefits over the use of virgin polyester, its use in fashion is far from the silver bullet for sustainability that many brands claim.

The fashion industry’s focus on rPET may even detract from more impactful solutions, such as reducing overall production, embracing circular fashion models, and investing in the development of more sustainable materials.

Moving Beyond rPET to Catwalk Circularity

For the fashion industry to genuinely advance towards sustainability, it must look beyond recycled polyester and address the root causes of its environmental impact. This includes rethinking design for longevity and recyclability, embracing natural and innovative bio-based fibers, and implementing systems for the reuse and recycling of all textiles. Brands must also be transparent about the limitations of rPET and work towards reducing their reliance on synthetic fibers altogether.

The adoption of recycled polyester by the fashion industry is a step in the right direction, but it is not the panacea for sustainable fashion. The hidden costs of rPET—environmental, economic, and social—highlight the need for a more nuanced approach to sustainability in the fashion sector.

By unraveling the sustainability myth of recycled polyester, we can begin to chart a path towards truly sustainable fashion practices that prioritize the health of the planet and its inhabitants over marketing narratives. The journey towards sustainable fashion is complex and challenging, but it is also an opportunity for innovation, collaboration, and transformation.

If you like this content and would like to help close the loop on plastic waste then join the adaPETation® Network by clicking on the button below.

USEful links

Share it

THE HISTORY OF PLASTIC

Throughout the history of plastic, PET has been crucial in keeping food fresh with lightweight and durable packaging solutions that have helped reduce food waste for almost a century. Learn all about the invention of plastic and the important role it has played feeding people and saving the lives of humans and elephants in the adaPETation® timeline of the history of plastic.

Home » Unraveling the sustainability myth in fashion